One of the good thing I have seen since when pandemic started is when people are more interested in managing their finances well. I have seen in most Facebook groups the talk and interest about investing. Investing is allocating funds or money you have extra of to generate income or profit. Investing can be daunting for new investors and this is where GInvest comes in.

What is GInvest?

GInvest is GCash investment feauture with ATRAM Trust Corporation. ATRAM Trust is a licensed trust corporation and the leading independent asset manager in the Philippines allowed by Bangko Cental ng Pilipinas to operate since October 2016. ATRAM Trust will be the one who manages funds that are invested via GInvest.

Why should I use GInvest?

GInvest on GCash is one of the safest and easiest way to invest. This is ideal for people who want to try out investing. It also has the lowest minimum investment amount at 50PHP. And since it is managed through GCash app, it is hassle-free and very accessible

Requirements to invest in GInvest

You just need two things to start investing on GInvest: a Verified GCash Account and funds in your GCash, at least 50PHP for the minimum investment.

How to invest in GInvest using the GCash App

To start investing with GInvest, you need to have VERIFIED GCash account first. If you don’t have a verified account, it is best that you do it now.

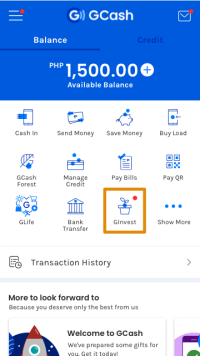

Go to the GCash homescreen and click on the GInvest icon. If you can not find it in the homescreen, click “Show More” and scroll down to the “Financial Services” where you will find the GInvest icon.

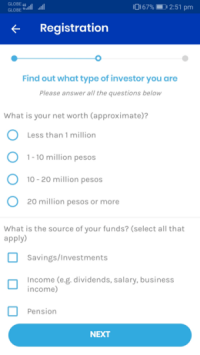

Click on the icon and start the Risk Profile Assessment

Proceed and answer the questions provided. These questions will assess your Risk Appetite as an investor. This is how GInvest can advise which funds best suits your risk appetite.

A Risk Appetite will show your personal attitude to risk, how much risk you need to take to achieve your investment goals, and your capacity for loss – how much you can afford to lose based on the questions you answered. This is important because it will be the basis on which Investment Product you should take so you will achieve your goals and minimize your capacity for loss.

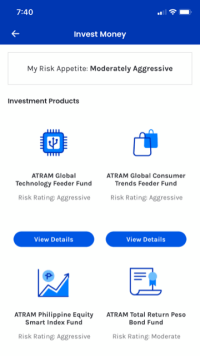

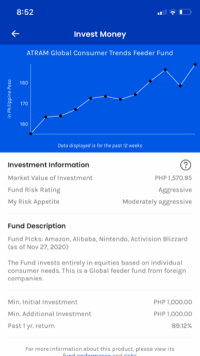

After clicking the “Next” button you will find out what your risk appetite is and can see what Investment Products are available for you to invest on. On each product you will find the Risk Rating. This will tell you the risk of losses caused by interest rate changes.

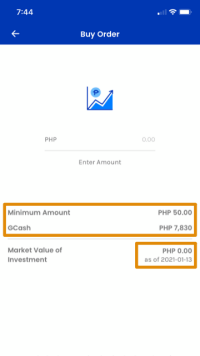

On the Buy Order, you will find the minimum amount that you can purchase, the amount of funds you have on your GCash account and the Market Value of Investment.

You need to have funds in your GCash account to purchase funds for investment, so make sure you have enough money.

Enter the amount you want to invest in product.

Once you have investment money on the fund product. You can check the Investment Information in the Invest Money by clicking on the View Investment Products when you open GInvest icon.

This will show you how the Investment Product is performing and you can decide whether to buy/add more to it or to sell/remove your investment from it.

Should you invest in GCash?

Invest with money that has no intended purpose. If you are planning to invest and give GCash a try and you are new to investing, make sure to sure money that has no intended use. Once you put money in, you can withdraw/sell your stocks but it has 1-2weeks holding period every transactions.

So bear that in mind every time you invest that it is not as easy as withdrawing money from the bank or your ATM.

Source: https://www.gcash.com/services/investments/